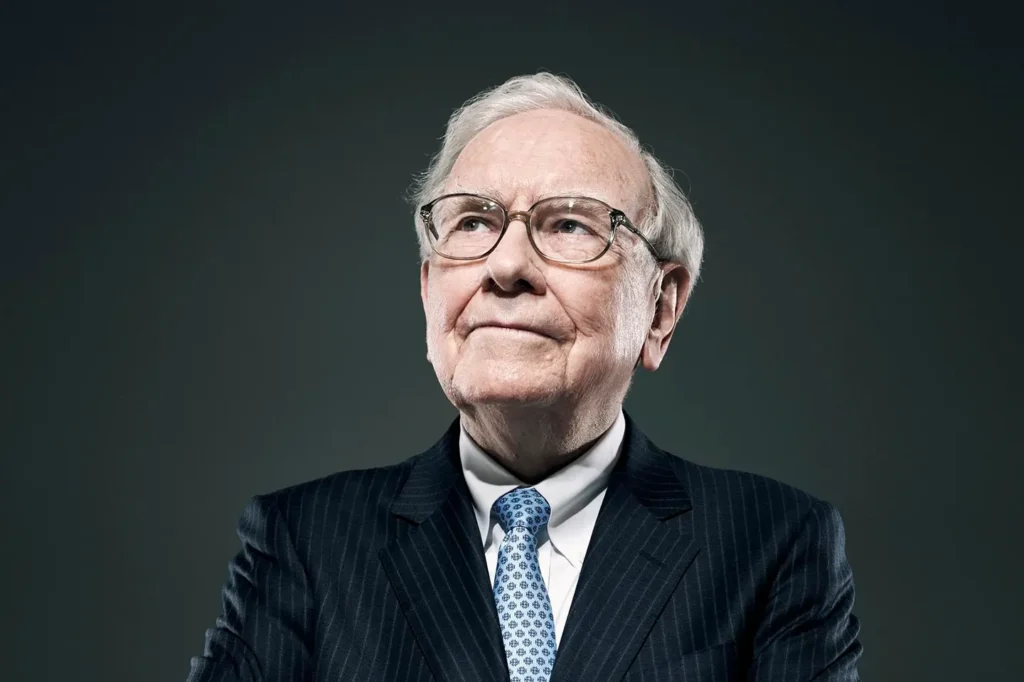

In the vast finance and investment landscape, one name stands out like a shining beacon of wisdom and wealth: Warren Buffett, often called the “Oracle of Omaha.” His journey from a young boy with a penchant for numbers to one of the world’s wealthiest individuals is a testament to his extraordinary investment understanding and a source of inspiration for countless aspiring investors and business leaders worldwide.

Warren Buffett’s story is the stuff of legends. He didn’t inherit massive wealth or attend prestigious Ivy League universities, yet he managed to amass a fortune through his unique approach to investing. Born in 1930 in Omaha, Nebraska, Buffett’s early life was a precursor to his later success. At a young age, he displayed a remarkable talent for mathematics and was known to pore over financial reports like most kids would their comic books.

What truly sets Warren Buffett apart is not just his immense wealth, which consistently places him among the top-ranked individuals on Forbes’ list of the world’s richest people, but his ability to simplify the complex world of finance into a set of timeless principles that almost anyone can understand and apply. His investment philosophy, often called “value investing,” has garnered him a cult-like following of investors who hang on his every word.

Early Life and Influences

Warren Edward Buffett was born on August 30, 1930, in Omaha, Nebraska, during the height of the Great Depression. His father, Howard Buffett, was a stockbroker and later a congressman, exposing young Warren to finance and politics from an early age. Buffett’s fascination with numbers and finance began manifesting in his childhood, and he quickly developed an affinity for financial matters that surpassed the typical interests of his peers.

One pivotal influence in Warren Buffett’s life was his exposure to Benjamin Graham’s book, “The Intelligent Investor.” Graham’s ideas about value investing and analyzing a company’s fundamentals struck a chord with the young Buffett. This book became the cornerstone of his investment philosophy and laid the foundation for his future success.

Buffett’s entrepreneurial spirit also emerged early. As a child, he engaged in various money-making ventures, including delivering newspapers, selling golf balls, and running a small pinball machine business. These early endeavors helped him develop a strong work ethic and honed his business acumen.

Despite his affinity for numbers and investing, Buffett was not a loner or a recluse. He was known for his outgoing personality and the ability to connect with people from all walks of life. This social skill would later become valuable in his business dealings and investment decisions.

Warren Buffett’s early years were marked by a relentless pursuit of knowledge and an insatiable curiosity about the financial world. These formative experiences and influences laid the groundwork for the investment genius he would become. As we delve deeper into his life and career, we will uncover how these early influences continued to shape his path toward becoming the Oracle of Omaha.

Investment Principles

Warren Buffett’s investment philosophy can be distilled into a few core principles, which have not only propelled him to staggering wealth but have also guided countless investors in their pursuit of financial success.

Value Investing

At the heart of Buffett’s strategy is the concept of value investing. He learned this approach from his early mentor, Benjamin Graham, and it forms the bedrock of his investment philosophy. Value investing involves buying undervalued stocks of companies with strong fundamentals and holding onto them long-term. Buffett famously said, “The stock market is designed to transfer money from the Active to the Patient,” emphasizing the importance of patience in value investing.

Long-Term Thinking

Buffett is renowned for his long-term perspective. He buys stocks to hold them indefinitely, often referring to his preferred holding period as “forever.” This long-term horizon allows him to weather market volatility and take advantage of the power of compounding.

Economic Moats

Buffett looks for companies with economic moats, a term he coined to describe businesses with competitive advantages that protect them from rivals. These moats can be in the form of strong brand recognition, high customer switching costs, or network effects. Investing in companies with economic moats provides a level of safety and predictability.

Margin of Safety

Buffett is a strong advocate of the margin of safety principle. He recommends buying stocks when trading below their intrinsic value, providing a cushion against potential losses. This approach minimizes risk and increases the likelihood of profitable investments.

Diversification

While Buffett emphasizes concentration in his top investments, he also values diversification to a certain extent. He has famously quipped that “Diversification is protection against ignorance. It makes little sense if you know what you are doing.” This approach means he doesn’t spread himself too thin but maintains a degree of diversification in his portfolio.

Continuous Learning

Despite his immense success, Buffett never stops learning. He devotes significant time to reading and staying informed about various industries and market trends. His voracious reading habit is a testament to his commitment to knowledge and adaptability.

These principles have made Warren Buffett one of the world’s wealthiest individuals and provided a roadmap for investors seeking to achieve financial success through prudent and disciplined investing.

Berkshire Hathaway

One of the most remarkable chapters in Warren Buffett’s storied career is his transformation of Berkshire Hathaway. Originally a struggling textile manufacturing company, Berkshire Hathaway became the vehicle for Buffett to implement his investment philosophy and build an empire.

From Textiles to Diversified Conglomerate

Warren Buffett acquired a significant stake in Berkshire Hathaway in the early 1960s when the company faced financial difficulties. Initially, he intended to profit from its stock, but he soon realized the textile business was unsustainable. Rather than liquidate the company, he decided to pivot. Berkshire Hathaway started to acquire other businesses, marking the beginning of its transformation into a diversified conglomerate.

The Berkshire Model

Under Buffett’s leadership, Berkshire Hathaway adopted a unique corporate structure. Instead of micromanaging its subsidiaries, he allowed them a high degree of autonomy. This approach, often called the “Berkshire model,” encourages the heads of subsidiary companies to run their businesses with minimal interference. This autonomy has allowed businesses within the Berkshire Hathaway portfolio to thrive and attracted other companies seeking a stable, long-term home.

Iconic Investments

Berkshire Hathaway’s investment portfolio includes iconic American companies, such as Coca-Cola, American Express, and Apple. Buffett’s knack for identifying undervalued companies with strong competitive advantages has been a key driver of Berkshire’s success. These investments’ dividends and capital appreciation have contributed significantly to the company’s growth.

Annual Shareholder Letters

One of the unique aspects of Berkshire Hathaway’s communication with shareholders is Buffett’s annual letter to shareholders. These letters are not just dry financial reports but masterpieces of investment wisdom and wit. Buffett shares insights into the company’s performance, investment decisions, and views on the broader economic landscape in these letters. They have become a must-read for investors and are often considered a treasure trove of financial knowledge.

Warren Buffett’s stewardship of Berkshire Hathaway has turned it into a conglomerate with diverse interests, from insurance and energy to consumer goods and technology. This transformation is a testament to his ability to adapt, innovate, and create lasting value through prudent investment strategies.

Wealth and Philanthropy

Warren Buffett’s journey through the world of finance has made him one of the wealthiest individuals on the planet and has also led him to profoundly embrace philanthropy’s principles.

The Billionaire Next Door

As of the most recent estimates, Warren Buffett’s net worth ranks him consistently among the top few individuals on Forbes’ list of the world’s richest people. However, his lifestyle remains remarkably modest. He resides in the same modest house in Omaha, Nebraska, which he purchased in 1958 for $31,500. His frugality and aversion to flashy displays of wealth have earned him the nickname “The Billionaire Next Door.”

The Giving Pledge

Warren Buffett’s philanthropic journey took a significant turn in 2006 when he announced his intention to give away most of his wealth to charitable causes. In 2010, he joined forces with Bill and Melinda Gates to launch the Giving Pledge, a commitment by some of the world’s wealthiest individuals and families to donate most of their wealth to address society’s most pressing issues. This initiative has garnered support from numerous billionaires worldwide, fostering a culture of philanthropy among the super-rich.

Berkshire Hathaway Share Donation

A significant portion of Buffett’s philanthropic contributions comes from Berkshire Hathaway shares. He annually donates shares to various foundations, including the Bill and Melinda Gates Foundation. These donations have had a transformative impact on the world of philanthropy and have led to substantial investments in health, education, and poverty alleviation.

Impact on Society

Warren Buffett has left an indelible mark on society through his philanthropic efforts. His contributions have supported initiatives ranging from healthcare and education to poverty alleviation and disaster relief. His belief in the power of giving has inspired other billionaires to follow suit, resulting in an unprecedented surge in large-scale philanthropy.

Legacy of Generosity

Warren Buffett’s commitment to philanthropy ensures that his wealth will continue to impact generations to come positively. His legacy extends far beyond his investment successes; it’s a testament to the profound difference one can make when one chooses to use their wealth to improve society.

Life Lessons and Quotes

Warren Buffett’s life and career are a treasure trove of wisdom and insights that extend far beyond finance. Here are some of his most impactful life lessons and quotes:

1. Invest in Yourself

“The best investment you can make is in yourself.”

Buffett’s dedication to continuous learning and self-improvement is a testament to this philosophy. He encourages everyone to invest in acquiring knowledge and skills throughout their lives.

2. The Power of Compound Interest

“My wealth has come from a combination of living in America, some lucky genes, and compound interest.”

Buffett’s wealth is not just the result of intelligent investments but also the magic of compound interest. He emphasizes the importance of starting early and letting time work in your favor.

3. Risk and Patience

“Risk comes from not knowing what you’re doing.”

Buffett believes that informed decisions and a long-term perspective are key to successful investing. Understanding the businesses you invest in reduces risk.

4. Humility and Honesty

“It takes 20 years to build a reputation and five minutes to ruin it. If you think about that, you’ll do things differently.”

Buffett underscores the importance of integrity and reputation. He’s known for his straightforward and honest communication.

5. Avoiding Speculation

“The stock market is designed to transfer money from the Active to the Patient.”

Buffett advises against speculative trading and promotes a patient, value-based approach to investing.

6. Simplicity

“I try to buy stock in businesses that are so wonderful that an idiot can run them. Because sooner or later, one will.”

Buffett prefers businesses with simple and understandable models, avoiding overly complex or risky ventures.

7. Giving Back

“If you’re in the luckiest 1% of humanity, you owe it to the rest of humanity to think about the other 99%.”

Buffett’s commitment to philanthropy underscores the idea of using wealth to improve society.

8. Lifestyle Choices

“I have every material thing I need. I know I’m very lucky.”

Despite his immense wealth, Buffett leads a humble and contented life, reinforcing that material possessions are not the key to happiness.

Legacy and Impact

Warren Buffett’s influence on the world of finance and beyond is immeasurable. Several key aspects characterize his enduring legacy:

Investment Philosophy Dissemination

Warren Buffett’s investment philosophy, often called “Buffettology,” has been widely disseminated and adopted by countless investors and fund managers worldwide. His emphasis on value investing, patience, and a long-term approach has influenced generations of investors.

Berkshire Hathaway’s Stewardship

A commitment to long-term value creation and ethical business practices has marked Buffett’s leadership at Berkshire Hathaway. His corporate governance and transparency approach has set a high standard for other companies to follow.

Philanthropic Inspiration

Buffett’s commitment to philanthropy, including the Giving Pledge initiative, has inspired a new era of large-scale charitable giving among the world’s wealthiest individuals. His dedication to giving back has sparked a global movement of billionaires pledging to use their wealth for the greater good.

Educational Impact

Buffett’s annual letters to shareholders, speeches, and interviews serve as valuable educational resources for aspiring investors and business leaders. He has imparted a wealth of knowledge and wisdom that continues to guide and educate individuals worldwide.

Bridging Finance and Mainstream Culture

Warren Buffett’s unique blend of financial wisdom, approachability, and wit has made him a cultural icon. He’s featured in documentaries, movies, and books, and his annual Berkshire Hathaway shareholder meetings have become legendary events.

Value Beyond Finance

Beyond finance, Buffett’s influence extends to fields like leadership, ethics, and decision-making. Business schools study his principles, and his life story exemplifies how integrity, discipline, and a strong moral compass can lead to success.

Impact on Policy and Regulation

Buffett’s outspoken views on tax policy, corporate governance, and financial regulation have shaped public discourse and influenced policy decisions globally.

Conclusion

Warren Buffett’s legacy is multifaceted and profound. He has left an indelible mark on finance, philanthropy, and leadership. His enduring impact inspires individuals to strive for financial success while adhering to principles of integrity, ethics, and giving back to society. Warren Buffett’s life and career are a testament to the notion that true greatness is achieved not just through wealth but through the positive influence one can have on the world.

Conclusion

Warren Buffett’s life and career are a captivating narrative of humble beginnings, astute investment acumen, and unwavering commitment to principles that transcend the world of finance. Known as the “Oracle of Omaha,” his journey from a young boy with a fascination for numbers to one of the world’s wealthiest individuals is a source of inspiration for millions.

Buffett’s early life and influences, including exposure to Benjamin Graham’s value investing philosophy, laid the groundwork for his remarkable success. His investment principles, emphasizing value, patience, and economic moats, have enriched him and guided countless investors toward financial prosperity.

Under Buffett’s guidance, Berkshire Hathaway transformed from a struggling textile company into a diversified conglomerate with iconic investments and a unique corporate structure. His annual shareholder letters, brimming with wisdom, are considered essential reading for investors.

Warren Buffett’s immense wealth is only rivaled by his commitment to philanthropy. He has set an example of using wealth to address society’s most pressing issues through initiatives like the Giving Pledge and annual stock donations to charitable foundations.

His life lessons and quotes offer timeless guidance, emphasizing the importance of continuous learning, integrity, and the power of compound interest. Buffett’s legacy extends to inspiring a culture of philanthropy, bridging finance with mainstream culture, and shaping policy and regulation.